CONFIDENTIAL. FOR INTERNAL USE ONLY.

Updated: July 09, 2025

Introduction

Goal

Ardley Intelligence transforms raw borrower data into actionable insights, empowering mortgage servicers and originators to optimize portfolio performance and maximize conversion opportunities. Intelligence provides real-time analytics and comprehensive reporting to drive data-driven decision making across your entire loan pipeline.

Overview

Ardley Intelligence delivers enterprise-class analytics that scale with your business needs. Our platform provides visibility into portfolio opportunities, borrower engagement patterns, and campaign performance through intuitive dashboards and robust data export capabilities. Intelligence seamlessly integrates with Navigator and Autopilot to create a complete view of your borrower lifecycle—from opportunity identification to loan origination.

Functionality

Ardley Intelligence operates as your command center for portfolio analytics, offering:

Real-time Portfolio Monitoring: Track loan opportunities across all categories with automated refresh cycles

Borrower Engagement Analytics: Monitor interaction patterns and conversion funnels to optimize campaign performance

Historical Performance Tracking: Access comprehensive data spanning your entire account history

Lead Management: Identify high-conversion prospects and prioritize sales outreach

Export Capabilities: Download detailed datasets for advanced analysis and reporting

Getting Started

Logging In

Access Ardley Intelligence through your dedicated portal using your enterprise credentials.

Requesting Users

Requesting Users

New user access requires approval through your account administrator. Contact your Ardley customer success representative to add team members or modify user permissions.

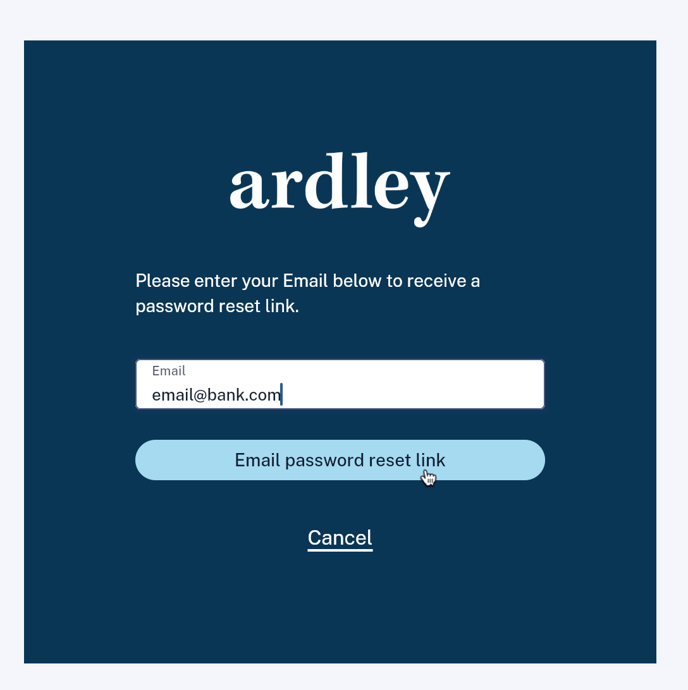

Setting Up or Changing Your Password

Passwords can be created or changed using the "Forgot Password" link on the login screen. Please contact your system administrator for password reset assistance if needed.

Dashboards

Ardley Intelligence offers multiple specialized dashboards, each designed to provide specific insights into different aspects of your portfolio and borrower engagement patterns.

Portfolio Analytics

Overview

The Portfolio Analytics dashboard provides comprehensive visibility into all loan opportunities within your portfolio, structured according to your contracted pricing, fees, and eligibility criteria. This dashboard serves as your primary tool for understanding portfolio composition and opportunity distribution.

🚨 Refresh Schedule: Updated nightly to ensure data accuracy and consistency

Snapshots Tab

The Snapshots tab delivers a high-level summary of your entire portfolio, segmented by loan category. This view enables quick assessment of opportunity distribution and potential loan volume across your contracted products:

Available Loan Categories:

- First lien cash out refinances

- Second lien equity withdrawals as closed-end seconds or lines of credit

- First lien rate and term reductions

- Properties listed on the MLS

![]()

Each category displays opportunity counts, potential loan volume, and portfolio percentage representation. Note that opportunity counts are not unique—individual borrowers may qualify for multiple loan opportunities across different categories.

Key Definitions:

Record: A unique borrower delivered to Ardley as a readable line in your intake file. Borrowers owning multiple properties are counted as a single record regardless of property count.

Solicitable: Borrowers that meet the “Solicitable” definition as defined during the onboarding process. This combines email deliverability scores and opt out requirements.

Detailed Loan Tabs

Each loan category features a dedicated tab providing granular insights into specific loan types. These detailed views include:

- Offered interest rate distributions

- Cash-to-close requirements

- Loan size distributions

- Eligibility breakdowns

Use these tabs to understand the composition and characteristics of opportunities within each loan category.

Controls

At the top of the dashboard you will see two standard controls:

Email deliverability - This allows you to view the portfolio holistically or to segment by email address quality

Market type (solicitation ability) - This allows you to filter on marketing categories to understand how many of the opportunities present in your portfolio can actually be campaigned

These controls can be used separately or in combination.

To learn more about email deliverability and solicitation, please visit the product documentation for Ardley Advantage

Interaction Analytics

Only available to customers using the product features outlined in Ardley Advantage

6 Months - Present, Interaction Analytics

This dashboard tracks real-time borrower engagement across all Ardley touchpoints, including campaign emails, Navigator interactions, and loan applications. The rolling 6-month view ensures you're always working with current engagement patterns.

🚨 Refresh Schedule: Updated hourly for real-time insights

⚠️ Data Range: Displays the most recent 6 months of interaction data

Core Metrics and Definitions:

- Total Borrowers Contacted (Distinct Emails Sent): Unique borrowers who successfully received Ardley campaign emails

- Distinct Impressions (Distinct Experience Start): Unique borrowers who clicked on an email campaign and loaded the experience, counted once per borrower regardless of interaction frequency

- Total Impressions: Total clicks and experience loads including multiple interactions per borrower

- Click Rate: Distinct Impressions ÷ Total Borrowers Contacted

Distinct Opens: Unique borrowers who opened campaign emails, counted once per borrower - Open Rate: Distinct Opens ÷ Total Borrowers Contacted

- Distinct Submits: Unique borrowers who submitted applications or inquiries

- App/Email Rate (End-to-End Pull-through): Distinct Submits ÷ Total Borrowers Contacted

- Launch to Submit Rate: Distinct Submits ÷ Distinct Impressions

- Application to Submit Rate: Measures application effectiveness by dividing Distinct Submissions by Application Starts (borrower authentication events)

Campaign Identification:

- Campaign Mnemonic: Human-readable campaign name including type and date

- Campaign ID: System-generated unique identifier for each campaign

Primary Borrower: Borrower designated as 'Borrower 1' or 'Primary Borrower' in the intake file

Note: Non-distinct rates for opens and clicks are available upon request.

Historical Dashboards

The Historical dashboard provides comprehensive interaction data spanning your entire account history, using identical definitions to the 6 Months - Present analytics. This view enables long-term trend analysis and performance benchmarking.

🚨 Refresh Schedule: Updated weekly

⚠️ Data Range: Complete account history

Lead Management

Only available to customers using the product features outlined in Ardley Advantage

Loan Interactions Dashboard

The Loan Interactions dashboard empowers sales teams to identify and prioritize borrowers who are engaging with offers but haven't yet submitted applications. This real-time intelligence enables proactive outreach to high-potential prospects.

🚨 Refresh Schedule: Updated hourly for immediate lead identification

⚠️ Data Range: Most recent 6 months of engagement data

Conversion Potential Categories

Borrowers are automatically segmented into three conversion likelihood categories:

High Conversion Potential

- Borrowers who selected an offer and initiated the application process but haven't submitted

- For Sidecar customers: These borrowers appear as "In Progress" in pipeline view

- Highest priority for immediate sales outreach

Medium Conversion Potential

- Borrowers who selected an offer but didn't begin the application process

- Strong interest demonstrated, requires engagement to move forward

Low Conversion Potential

- Borrowers who engaged with Navigator but didn't select a loan offer

- May require different messaging or product positioning

Lead Details and Interaction History

Each prospect is listed by email address and loan number with the date of their most recent activity. Borrowers may appear under multiple dates reflecting engagement across different sessions.

⚠️ Important: Count column numbers represent clicks per session, not session count for that day.

Clicking any borrower's email address automatically filters the "Detail view" below, providing comprehensive interaction history including:

- Campaign participation

- Navigation patterns

- Engagement timeline

- Interaction depth

Refer to the Interaction Analytics definitions for detailed metric explanations.

Performance Tracking

Only available to customers using the product features outlined in Ardley Advantage

End of Month Review

The End of Month Review dashboard automatically generates comprehensive performance summaries, updating on the first day of each month with previous month's data. This automated reporting ensures consistent performance tracking and month-over-month comparison.

🚨 Refresh Schedule: Monthly, first day of each month

⚠️ Data Range: Complete account history with month-over-month comparisons

Executive Summary

The Executive Summary provides high-level performance overview and comparative analysis. For example, November's dashboard compares November performance to October, enabling quick identification of trends and performance changes.

Offer Count Visuals display:

- Availability of each offer type

- Associated average interest rates

- Holistic portfolio composition (not limited to contacted borrowers)

Key Definitions:

- Engaged Borrowers: Borrowers who interacted with any Ardley experience

- Borrowers Contacted: Unique borrowers who successfully received Ardley campaign emails

Performance Sections

Performance data is organized into three focused areas:

- Email Performance

- Delivery rates and engagement metrics

- Open and click performance trends

- Campaign effectiveness comparison

- Submission Performance

- Application completion rates

- Conversion funnel analysis

- End-to-end pull-through metrics

- Borrower Experience

- Navigation patterns and engagement depth

- User journey optimization insights

- Experience effectiveness measurement

Note: Open and click rates exceeding 100% indicate multiple interactions per borrower.

Data Export and Analysis

Raw Data Tables

Intelligence provides comprehensive data export capabilities for advanced analysis and integration with external systems. Raw data tables are available upon request and can be downloaded directly from any dashboard.

Downloading Data

Export Process:

- Navigate to desired visual or table

- Click the three dots (⋯) in the top right corner

- Select "Export to CSV" or "Export to Excel" from dropdown menu

Wait for processing (may take several minutes for large datasets)

Understanding Exported Data

Data Structure:

- Primary Borrower User ID: Unique identifier shared across all campaigns and datasets for each borrower

- Collection ID: Identifier that associates borrowers with specific campaigns

- Campaign ID: Umbrella identifier for campaigns, linked to Campaign Mnemonic

- Campaign Mnemonic: Human-readable campaign name (e.g., "Woodley Bank Cash Out 2.19")

- Customer ID: Your unique Ardley customer identifier (borrower data cannot span multiple customers)

Event Types

Event_type drives most Intelligence reports and encompasses the full range of borrower actions. Understanding event types enables sophisticated analysis of borrower behavior and campaign effectiveness.

Email Interaction Events:

- _email.send: Email successfully delivered

- _email.open: Email opened by borrower

- _email.click: Email link clicked

- _email.complaint: Email marked as spam

- _email.softbounce: Temporary delivery failure

Authentication Events:

- user.verification.email.fail: Incorrect OTP provided

- user.verification.email.success: Correct OTP provided

- user.challenge.init: Steps 2&3 of verification initiated

- user.challenge.fail: Verification step failure

- user.challenge.success: Successful verification completion

Application Events:

- loan.app.link.clicked: Application link clicked (typically phone number)

- loan.app.navigation: Borrower navigating within application

- loan.app.submitted: Loan application submitted

Offer Events:

- server.offer.created: Offer successfully calculated and presented

- Navigation Analysis: Use loan.app.navigation events with app_section_id and

- app_page_id fields for detailed journey analysis:

- app_section_id: Section title from navigation bar (Personal Info, Demographics, etc.)

- app_page_id: Specific page within section (0 = first page, 1 = second page, etc.)

For additional support or advanced analytics consultation, contact your Ardley customer success representative.